Litigation Services & Support

In addition to legal counsel and litigation, we provide clients with value-added services, including:

Alternative Fee Arrangements

Jackson Walker acknowledges the need for cost containment, predictability, and meeting budgets. We work with clients to develop budgets on litigation matters.

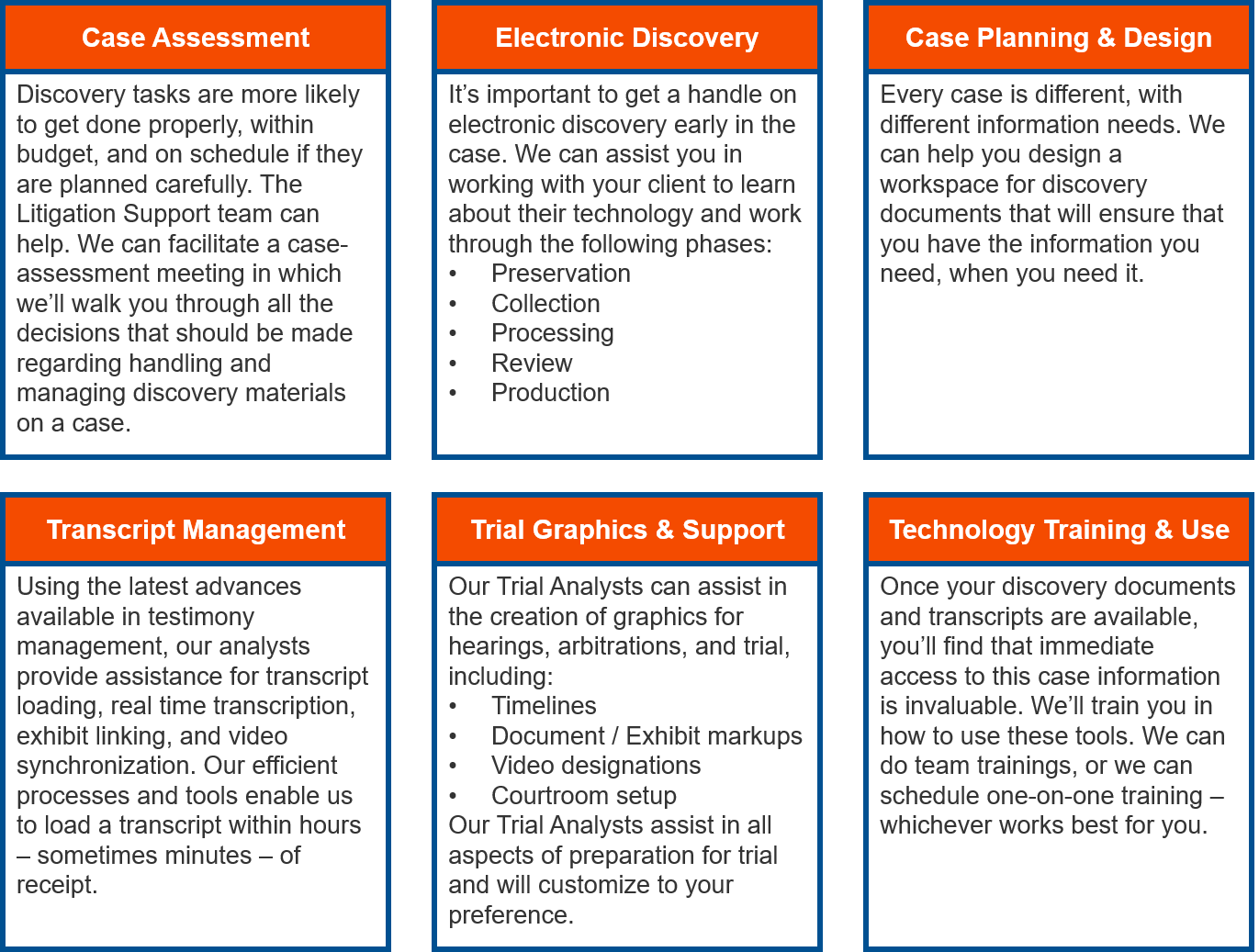

Electronic Discovery

Today, more than ever, the high-stakes world of complex litigation and governmental investigations demands sophisticated counsel capable of skillfully navigating the potentially-treacherous waters of Electronically-Stored Information (ESI). We expertly guide clients through every phase of the e-discovery lifecycle, from the creation of sound document retention programs to the processing and production of vast amounts of electronic data. In federal and state court litigation nationwide, we have represented corporations against the likes of Procter & Gamble, Microsoft, and Hewlett-Packard, in matters involving the preservation, collection, production and management of large volumes of ESI.

Project Management

We recognize that predictability and cost control are critical to our litigation clients. As a result, we work with our clients to develop an effective litigation strategy and an appropriate budget for litigation. We then keep our clients informed of our progress and any changes throughout the litigation.

Technology and Litigation Support

We know technology. We have always been a leader in finding innovative ways to utilize technology in order to serve our clients more efficiently, and at a lower cost. Today, we continues this tradition by deploying the latest products and tools available in information systems, communications, case and project management, electronic information processing, and courtroom technology.

October 3, 2023

Attorney News

Ali Andrews Expands Jackson Walker’s Tax Practice in Austin

Jackson Walker is pleased to announce the addition of Ali Andrews as senior counsel in the Austin Tax practice. Joining from an international firm, Ali concentrates her practice on handling state and local tax disputes, state tax audits, unemployment tax matters, equal taxation, multi-state tax planning, and other administrative law matters.