By Chuck Campbell and Alyca Garrison

During the 89th Texas Legislative Session, two key changes were made to the posting requirements under the Texas Open Meetings Act that governmental entities should be aware of. These changes take effect on September 1, 2025.

Agenda Posting Requirement Is Now 3 Business Days (Not 72 Hours)

The first change applies primarily to local governmental entities, including pension funds. As the law currently reads, notice of a meeting of a governmental body must be posted “at least 72 hours before the scheduled time of the meeting” unless an exception applies (such as the longer posting requirement for statewide plans or the shorter window for emergency meetings).[1]

House Bill 1522 amends this provision to require posting of the agenda “at least three business days before the scheduled date of the meeting” unless an exception applies.[2]

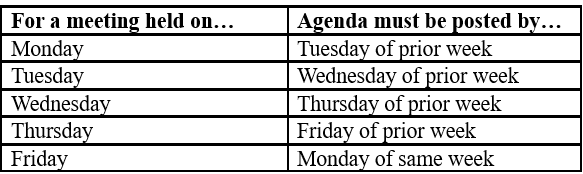

Rather than posting based on a particular meeting time, an agenda must now be posted for a minimum of three full business days prior to the meeting date (and not counting the date of the meeting). In counting the deadline, you must account for weekends and holidays as non-business days.[3]

In order to comply with the new requirements, local pension funds should post agendas for meetings held on or after September 1, 2025, in accordance with the following schedule:

New Budget Posting Requirement

House Bill 1522 also adds a new posting requirement for an agenda in which a governmental entity’s budget will be considered. [4]

Starting September 1, 2025, the agenda for a meeting in which a governmental body will discuss or adopt a budget must include a physical copy of the proposed budget to be considered, unless a copy of the budget is clearly accessible on the home page of their website. The key to complying with this new provision is to ensure the public has access to the entity’s budget prior to consideration of, or a vote on, the budget.

The bill also requires each agenda in which a budget will be considered to include a taxpayer impact statement that shows a comparison of the impact that the budget’s adoption will have on property taxes for the median-valued homestead property. This language is unclear for pension funds which have no taxing authority, and the adoption of a pension fund’s budget does not directly impact property tax rates.

Nonetheless, until we receive further guidance on how to apply this provision, we believe the prudent approach is to include a brief statement on an agenda in which a budget will be considered stating that the adoption of the pension fund’s budget will have no direct impact on property taxes.

[1] See 551.043(a), Tex. Gov’t Code.

[2] See 551.043(a), Tex. Gov’t Code (as amended by HB 1522).

[3] Unless and until we receive further guidance, we believe it is reasonable to apply the definition of a “business day” under the Texas Public Information Act for these purposes as both laws relate to open government and transparency requirements. See Tex. Gov’t Code Sec. 552.0031.

[4] See 551.043(c), Tex. Gov’t Code (as amended by HB 1522).

The opinions expressed are those of the author and do not necessarily reflect the views of the firm, its clients, or any of its or their respective affiliates. This article is for informational purposes only and does not constitute legal advice. If you have any questions on how these changes will impact your pension fund, please reach out to one of our Employee Benefits & Executive Compensation (EBEC) attorneys for assistance.

Meet Alyca

Meet Alyca

Alyca Garrison represents public and private sector clients in all areas of employee benefits and executive compensation. A significant part of Alyca’s practice involves representing and advising municipal and statewide public pension plans on a variety of issues arising under federal and state law, including plan administration and benefits, open meetings and open records, statutory interpretation, fiduciary and governance matters, plan qualification, tax compliance, and plan investments.

Meet Chuck

Meet Chuck

Chuck Campbell’s practice focuses on representing public pension plans and their trustees. He specializes in addressing the variety of complex and unique issues that these organizations face with a keen awareness of the political and regulatory environment in which these plans operate. He serves as primary outside counsel for various local pension plans and as fiduciary or tax counsel for larger statewide and local funds. Chuck also represents private sector clients in all areas of employee benefits and executive compensation, including the design, drafting, and compliance aspects of retirement plans, health and disability plans, deferred compensation plans, stock option and equity compensation plans, and executive employment agreements.

Meet Alyca

Meet Alyca Meet Chuck

Meet Chuck