As the startup community continues to expand around the country, there is an ever-growing need to understand different ways that a company can structure early stage financing so that it can be equipped to discuss with its first investors. Earlier rounds of financing, often referred to as “friends and family” or “angel” rounds, provide that first needed capital infusion to the company. There are different instruments to accomplish such capital raises, each having certain impacts on the company, its investors, and subsequent financing rounds. Although convertible notes and the sale of shares of a series of preferred stock have been the traditional forms of raising capital, each of these vehicles exhibits certain drawbacks, and the markets continue to evolve to address these concerns. Most recently, this has been through the introduction of Y-Combinator’s SAFE and 500 Startups’ KISS agreements, which seek to provide entrepreneurial-friendly features and streamline the fund raising process. In order to equip entrepreneurs and earlier investors, the following is a summary of these new structures along with distinguishing features of each type of financing.

Convertible Notes: Convertible Notes are the most frequently used instrument in raising capital at the seed stage of financing outside of a straight equity offering. These short-term, unsecured debt instruments have the ability to convert into equity upon the close of a qualified subsequent round of financing, a corporate transaction or after a certain maturity date. Typically, the instrument is used as a bridge financing to fill the needs for capital before the company is able to put together a later equity round, but it can be used by early investors as preliminary financing when the parties are not ready or able to address company valuations, or the amount being raised is small enough that it does not warrant expending resources on preparing more complicated documents. The company benefits from using a convertible note because it is not required to ascertain a company valuation (other than any cap on the conversion price the parties may agree to). Investors benefit from this instrument because the convertible note can include agreed upon discounts to the pricing and/or valuation caps in the subsequent round of financing, in addition to other forms of investor protections the parties may negotiate for.

SAFE (Simple Agreement for Future Equity): The SAFE is a funding model created by the startup accelerator Y-Combinator in order to facilitate a simpler funding process for early-stage companies while reducing transaction costs.1 The SAFE appears in four forms,2 but the basic premise is that it is a convertible security which offers investors the right to receive equity after a subsequent round of financing. Similar to convertible debt, a SAFE offers equity to its holders at a lower price than investors in the company’s future equity round, through a discount rate and/or valuation cap. However, such security does not bear interest or have a maturity date, unlike its convertible debt counterpart. This means that investors wait an undetermined amount of time before their security converts into stock, with the possibility that such conversion will never occur. Although the significance of this instrument is uncertain, as it is relatively new to the market,3 it offers benefits to both the investor and to the company. First, the removal of the maturity date eliminates the “ticking time bomb” aspect of the convertible note, where the company may be forced to take a less friendly round or will otherwise have its notes called into default without an ability to pay. Realistically, most investors do not call a default on traditional convertible notes, as investors understand that an early stage company will have little or no means to pay back the convertible note when follow-on financing has not arrived. Second, the removal of interest addresses the concern that when interest accumulates over a long period of time, a convertible note effectively becomes further discounted. Additionally, investors have found that interest accrual is problematic because companies generally will not repay interest in cash, yet investors owe taxes on the phantom gains arising from the accumulation of interest over the life of the convertible note until conversion. The SAFE, therefore, simply removes two problematic features of a convertible note while retaining the other terms of the note, and can be viewed as extending the continuum of initial notes with discounted conversion prices and convertible notes, which include the concept of cap pricing, in order to provide investor protection.

KISS (Keep It Simple Security): The KISS documents were created by 500 Startups with a similar intent of SAFE – allowing companies to raise funds with relative ease and minimal transaction costs.4 The KISS, however, attempts to address some of the criticisms of SAFE by providing certain investor rights and protections. This alternative financing model comes in two forms: KISS Debt and KISS Equity. The KISS Debt instrument, similar to a convertible note, maintains the accrual of interest on the instrument as well as the maturity date by which the holder may convert the security into equity. The KISS Debt also provides certain protective rights to investors, including most favored nations protections, information rights and participation rights for “major investors”.5 The KISS Equity has all the same features of KISS Debt, sans the accrual of interest and maturity date, making it more akin to the SAFE. The inclusion of certain rights and protections makes it more appealing to investors, however it remains unclear as to whether this instrument will gain traction in the market due to the additional terms which are more investor friendly.

Series Seed: The series seed round of financing provides an alternative to a traditional issuance of common stock or the issuance of a new class of preferred stock. The Series Seed is, from a pure legal perspective, a class of preferred stock, but has only streamlined preferential treatment over common stock by including a preferred return, voting rights, and the ability to convert the preferred stock into common stock. Investors find this option attractive because they have the ability to control the term sheet and negotiations at the time of investment, and companies like this option because it generally does not involve all of the features of a true preferred round. Additionally, companies find this offering advantageous because the parties know the number of shares issued and the full impact of dilution at the time of closing, unlike convertible notes and SAFEs. The primary disadvantage in the use of series seed financing is that it requires additional expenses due to heavier negotiations for additional investor protections, the increase in the complexity of the documents, and the need to file an amendment to the Certificate of Incorporation creating the Series Seed shares.

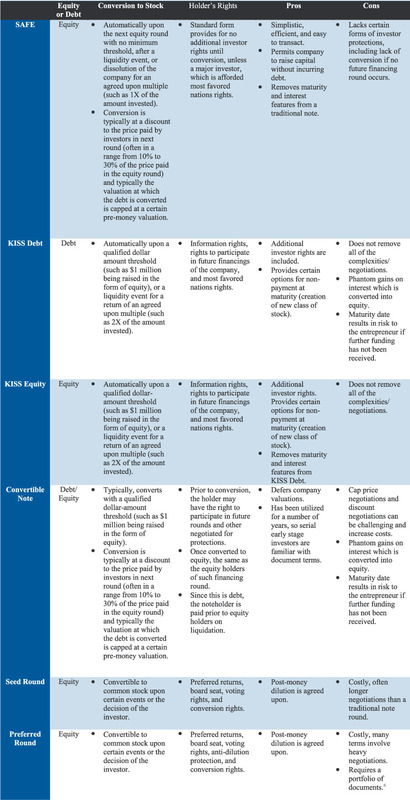

The following table allows for an easy comparison of the financing options available as an investor or entrepreneur:

Of course, each of the foregoing instruments are subject to certain levels of negotiation, as each can be more or less complex. If selecting one of the new “model” approaches, such as SAFEs or KISSes, we would recommend the parties agreeing, at least to a material degree, to utilize the standard forms, otherwise the negotiations can be protracted. Additionally, the sale of each of these instruments is the sale of a security so entrepreneurs, investors and those that assist in the fundraising must comply with applicable state and federal securities and broker-dealer laws (see “Practical Guide to Raising Capital” for additional information.7 An entrepreneur may also consider a myriad of other forms of access to capital including Kickstarter-type campaigns (where the entrepreneur is preselling the product rather than selling ownership in the venture through the sale of a security) or grants such SBIR funds.

The JWStartup program at Jackson Walker seeks to be a resource to entrepreneurs and early stage investors. If you have any questions regarding any of the options discussed in this eAlert, please contact Stephanie Chandler at schandler@jw.com or any of the other members of the JWStartup team.

Stephanie Chandler brings a deep-seated work ethic to representing her clients, rolling up her sleeves and working alongside them to help achieve their business goals. Stephanie believes strongly in partnering with her clients, helping them build their businesses. Her track record of working with clients from the earliest stages of their development through significant liquidity events, typically in the role of outside general counsel managing the legal issues related to each growth stage, allows her to bring a uniquely broad-based perspective to the matters she handles.

______________________________________________

1 The SAFE document itself is short in length, with its form base agreement only being 5 pages. See Startup Documents (Feb. 2016), https://www.ycombinator.com/documents/.

2 The SAFE base documents include: (i) valuation cap, (ii) discount rate, (iii) valuation cap and discount rate, or (iv) no valuation cap or discount rate, but most favored nations rights.

3 See, e.g., Crowdnetic, Quarterly Research (Sept. 23, 2015), available at http://www.crowdnetic.com/reports/sep-2015-report.

4 Gregory Raiten, 500 Startups Announces ‘KISS’(July 3, 2014), http://500.co/kiss/.

5 “Major Investor” is defined as an Investor who purchases one or more KISSes with an aggregate purchase price of at least $50,000, available at https://500startups.app.box.com/s/8ybxx9y3bhk4mte50v7k.

6 See, e.g. model documents made available at nvca.org.

7 See, e.g. Securities and Exchange Commission v. W. J. Howey Co., 328 U.S. 293 (1946) which provides that any investment of money in response to an expectation of profits arising from a common enterprise depending solely on the efforts of a promoter or third party is the sale of a security.