With the Inflation Reduction Act of 2022 now signed into law, there are a number of changes to federal tax and healthcare laws. Jackson Walker attorneys Nick Diamond and Ashley Withers joined the Fast Takes podcast for a brief overview of key changes.

Related Insights:

- Next Steps for Healthcare and the Inflation Reduction Act »

- Planning for 2023 and Beyond – Tax Changes in the Inflation Reduction Act of 2022 »

- What the Energy Industry Should Know About the Inflation Reduction Act »

Here is a transcription of the episode, “How the Inflation Reduction Act Changes Tax and Healthcare Laws”:

Greg Lambert: Hi, everyone. I’m Greg Lambert, and this is Jackson Walker Fast Takes. President Biden signed the Inflation Reduction Act of 2022 into law, which has major changes in tax laws, health laws, and more. I asked Ashley Withers in our Tax practice group along with Nick Diamond in our Healthcare practice to sit down with me and go over a few of the items in the law that affect their clients. Ashley and Nick, thanks for joining me.

Ashley Withers: Thanks for having me, Greg.

Nick Diamond: Thanks, Greg.

Greg Lambert: So, Ashley, let’s start off with you. What are the law’s key tax component changes, and what are some of the major areas that clients need to be made aware of?

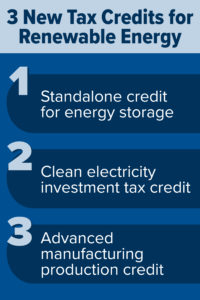

Ashley Withers: The big, big area that clients need to be aware of is the new renewable energy tax credits that this act is going to be putting in place. Some of these tax credits are extensions and amendments of existing credits and some are completely brand new.

So, one of the credits that is really kind of unprecedented and is garnering a lot of interest is a new standalone credit for energy storage. Previously, the only time that a tax credit has been allowed for energy storage is when it’s been paired with solar or other projects claiming an investment tax credit. But this is the first time that energy storage standing by itself can qualify for a tax credit. Some of the big items in terms of tax credits that people will probably be interested in is the investment tax credit. That’s existing, and it’s been extended for another 10 years. The availability of the credit is a lot bigger if certain wage and apprenticeship requirements are met. There’s also the clean electricity investment tax credit, which is available for any investment and qualified facility and storage facility that’s placed into service after December 31, 2024, and produces or stores electricity with a greenhouse gas emissions rate of zero. There’s also the Advanced Manufacturing Production Credit, which is available for the production of eligible components produced in the U.S. and sold after December 31, 2022.

So, one of the credits that is really kind of unprecedented and is garnering a lot of interest is a new standalone credit for energy storage. Previously, the only time that a tax credit has been allowed for energy storage is when it’s been paired with solar or other projects claiming an investment tax credit. But this is the first time that energy storage standing by itself can qualify for a tax credit. Some of the big items in terms of tax credits that people will probably be interested in is the investment tax credit. That’s existing, and it’s been extended for another 10 years. The availability of the credit is a lot bigger if certain wage and apprenticeship requirements are met. There’s also the clean electricity investment tax credit, which is available for any investment and qualified facility and storage facility that’s placed into service after December 31, 2024, and produces or stores electricity with a greenhouse gas emissions rate of zero. There’s also the Advanced Manufacturing Production Credit, which is available for the production of eligible components produced in the U.S. and sold after December 31, 2022.

Now, regarding these credits, the big thing that makes them so unique is that they are actually transferable to third parties. Previously, these types of credits have not been. In terms of their transferability, they are transferable – either total or a piece of them – to an unrelated party. The only thing is that these credits are transferable once. Once they have been transferred, the recipient cannot transfer them again. Also, the credits cannot be transferred to a tax-exempt entity, state or local government, or political subdivision. The transferability of these—as well as all the other credits that I mentioned—none of this goes into effect until 2023. Also, there’s a three-year carryback period for these credits. So, this can open up more options in terms of tax planning and offsetting your income from previous tax years.

Greg Lambert: Ashley, are there any increases in taxes that people need to be aware of?

Ashley Withers: The biggest changes that we’re seeing are for corporations. There is a 15% minimum book tax that this act is imposing. Now, that book tax is different than the normal 21% current tax on a corporation’s adjusted gross income. How this is designed to work is that under the act, a C corporation with at least $1 billion in net income is subject to the greater of the current 21% tax on a C corporation’s adjusted gross income or a 15% tax on a C corporation’s adjusted financial statement of income, which is generally the C corporation’s book income, which is essentially GAAP with some adjustments.

There has been some concern surrounding how you get to this $1 billion threshold, and that concern is that under the single-employer rules of ERISA, a lot of entities are going to be aggregated. So, while you may have one C corporation that does not quite hit that $1 billion threshold, once you aggregate it with other controlled entities – some that may or may not include C corporations – the impact of this minimum book tax might be more expansive than originally was thought. That’s something we’re going to be keeping a close eye on to see how that plays out in the future.

Also, for corporations, there is a 1% excise tax on stock buybacks, but that new tax is only applicable to publicly traded corporations.

Greg Lambert: So, Ashley, was there anything missing that didn’t make it into the final version of the law?

Ashley Withers: Yes. So, one of the last-minute changes to the act before it went before the Senate and House was that the proposed changes to carried interests – that was taken out. As originally proposed, the carried interest that fund managers have in the private equity world – the proposal was to change their current three-year holding period in order to entitle them to capital gains tax on exit. The proposal was to raise that to five years. However, that was taken out at the last minute. Currently under the act, there is no change in the state of the law regarding carried interests.

Greg Lambert: Thanks, Ashley. So Nick, will bring you up to the plate now. From a health care view, what’s the laws impact, say, on drug companies?

Nick Diamond: Well, Greg, there’s likely to be a very significant impact not just to drug companies, but also across all stakeholders in the healthcare ecosystem, just because drug pricing and access tends to be a complex contractual set of relationships between providers, payers, and drug companies. So, we’re likely to see a pretty broad impact here over the next couple of years.

In terms of provisions in the bill – or the new law, rather – they’re likely to really get the most attention, have the most significant impact. The first one is the law enables the negotiation of drug prices in the Medicare program. It’s not wholesale negotiation. The law limits the types of drugs and the number of drugs that the federal government can negotiate the price of. Essentially, the provisions are designed to only allow for negotiation of single-source, higher-cost drugs sold – or used, rather – within the Medicare program, rather than sort of all prescription drugs taken by Medicare beneficiaries.

In terms of provisions in the bill – or the new law, rather – they’re likely to really get the most attention, have the most significant impact. The first one is the law enables the negotiation of drug prices in the Medicare program. It’s not wholesale negotiation. The law limits the types of drugs and the number of drugs that the federal government can negotiate the price of. Essentially, the provisions are designed to only allow for negotiation of single-source, higher-cost drugs sold – or used, rather – within the Medicare program, rather than sort of all prescription drugs taken by Medicare beneficiaries.

The second part of the new law that’s really rather significant is the addition of what has been called inflationary rebates. Essentially, if a prescription drug’s cost year-to-year rises faster than inflation for that year, the drug manufacturer would be required to pay a rebate to the federal government in the amount of that delta. So, the difference between the cost of the drug and the inflation adjusted cost for that given year. That will apply not to the limited set of drugs for which the prices can be negotiated, but to a much, much wider spectrum of drugs under the Medicare program.

Finally, the third rather notable change in the law deals with the redesign of the Medicare Part D benefits. The Part D benefit is the prescription drug coverage part of the Medicare program. Basically, the Part D benefit determines how costs are apportioned between enrollees (the patients, the federal government, drug companies, and health insurance companies offering Part D plans). And basically, the changes in short form here are designed to shift over the next couple of years more of the cost to both drug manufacturers and Part D plans and away from patients and, to a lesser extent, away from the federal government. So, what this will do over time—it’s likely to change the incentives for these different actors within the ecosystem. Again, this really goes to the likelihood that we’ll see ripple effects for this law across the entire healthcare ecosystem.

Greg Lambert: And Nick, is there anything in the law related to vaccines?

Nick Diamond: Well, this is the interesting part, Greg, that was sort of buried at the end behind all the drug pricing negotiation provisions that were getting most of the airtime. So, there are a couple provisions at the end of the law related to vaccine coverage and specifically cost sharing – what a patient would pay out-of-pocket for certain vaccines. What the law did is eliminate cost sharing for vaccines covered under Part D. Now, certain vaccines are covered under Part B and certain are covered under Part D. This is just a peculiarity of how the law was written many years ago, and under Part B vaccines don’t have any cost sharing. For example, if you’re in Medicare, you go get a flu shot at a pharmacy, you don’t pay any cost sharing for it. But if you went to that same pharmacy and got, for example, a shingles vaccine, which is covered under Part D, it used to be the case that you would have to pay likely a bit of cost sharing, so a little bit out of your pocket for that vaccine. That was really seen as an access barrier for ensuring that all Medicare-eligible individuals were up-to-date on their routine immunization. So, what this bill does is remove that cost sharing for Part D vaccines in that it also removes cost sharing for any recommended vaccinations within the Medicaid and Children’s Health Insurance Protection Program (CHIP). One of the peculiar parts about the Medicaid program is because of the state-to-state differences in how each state administers its Medicaid program, what happens is certain states have cost sharing for immunizations in Medicaid and others don’t. It creates disparities then, which have public health implications state-to-state, so the law actually removes cost sharing across all Medicaid programs here in the coming years.

Greg Lambert: Thank you, Nick. All right, Ashley Withers and Nick Diamond. Thanks again for joining me.

Ashley Withers: Thanks, Greg.

Nick Diamond: Thanks.

The music is by Eve Searls.

This podcast is made available by Jackson Walker for informational purposes only, does not constitute legal advice, and is not a substitute for legal advice from qualified counsel. Your use of this podcast does not create an attorney-client relationship between you and Jackson Walker. The facts and results of each case will vary, and no particular result can be guaranteed.

Meet Our Team

Nicholas J. Diamond is a regulatory lawyer with extensive, international experience counseling clients across the health sector, including life sciences companies, medical device companies, technology companies, retail pharmacies, medical distributors, industry trade organizations, and nonprofits. He maintains a global practice focused on regulatory, public policy, and ethics issues impacting the U.S., the Asia-Pacific region (APAC), Latin America, the European Union (EU), and the Middle East. For questions about healthcare law changes in the Inflation Reduction Act of 2022, contact Nick or any member of the Healthcare practice.

Ashley P. Withers advises clients on a wide variety of tax matters. She has a broad-based tax practice that includes representing businesses, family offices, tax-exempt organizations, and individuals on tax strategies, compliance, and tax-efficient organizational structuring. Ashley’s practice also includes representing businesses and individuals in tax controversy matters. In her controversy practice, she has successfully defended clients in IRS audits and appeals and secured favorable private letter rulings. For questions about tax implications in the Inflation Reduction Act of 2022, view the Jackson Walker article “Planning for 2023 and Beyond – Tax Changes in the Inflation Reduction Act of 2022,” or contact Ashley or any member of the Tax practice.